In the realm of financial analysis, strategies centered around indicator analysis have long been a cornerstone for traders seeking to discern potential market movements. This exploration delves into a potent combination of tools—Relative Strength Index (RSI) and Bollinger Bands—to capitalize on volatility-driven mean reversion opportunities. The convergence of these established indicators offers a robust framework for identifying and executing trades, particularly during periods of market consolidation and subsequent breakout potential.

Understanding the Tools

The core of this strategy lies in understanding the individual strengths of the RSI and Bollinger Bands, and how their signals can complement each other.

Quick Refresher: What is RSI?

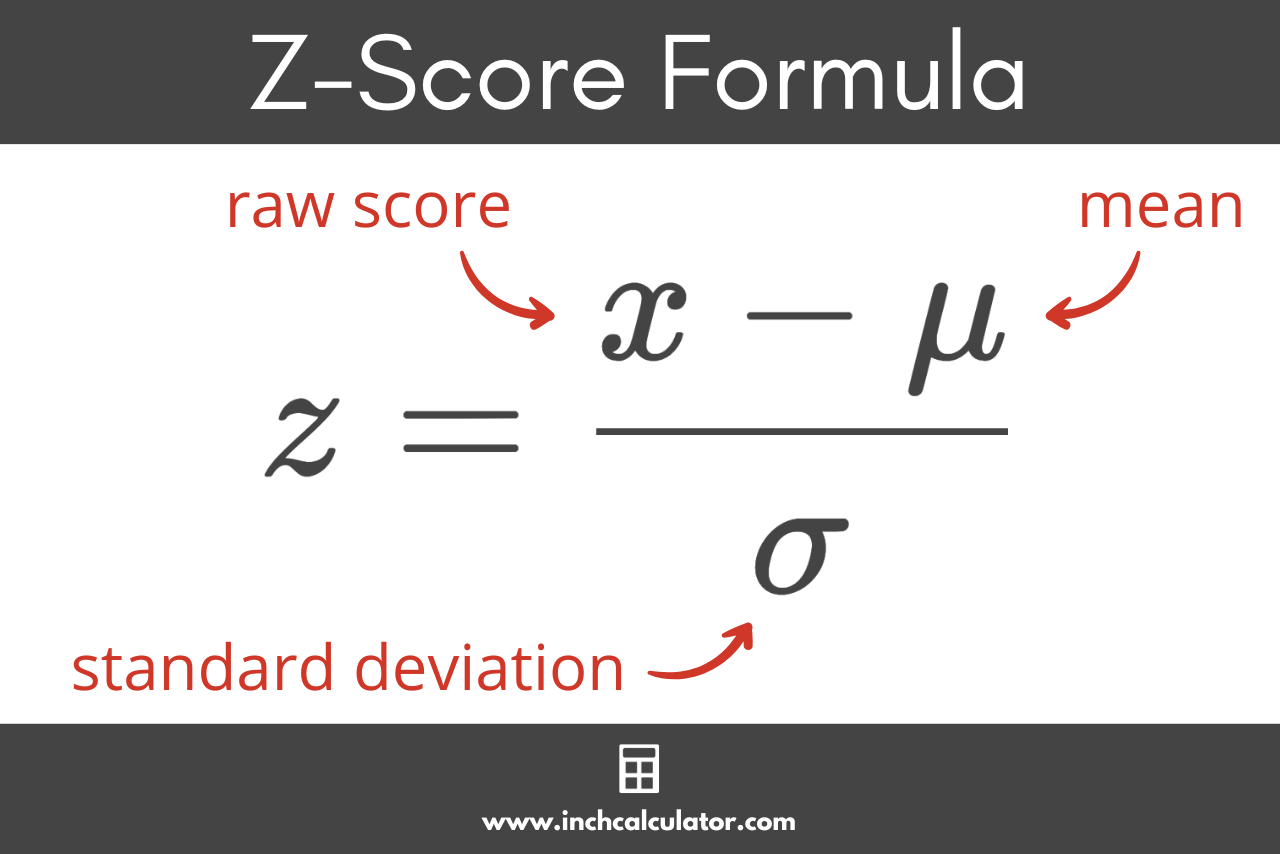

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It oscillates between 0 and 100. Traditionally, RSI is considered overbought when above 70 and oversold when below

30. This information can signal potential reversals or continuations of price trends. RSI assists in determining whether an asset is being overbought or oversold, providing insight into the strength of recent price movements. It is vital to recognize that overbought and oversold conditions can persist for extended durations, particularly in strong trending markets. Therefore, RSI should be used in conjunction with other trading indicators and analysis techniques.

How Bollinger Bands Work and What a “Squeeze” Means

Bollinger Bands consist of a simple moving average (SMA) and two standard deviation bands plotted above and below the SMA. These bands expand and contract with volatility. A "squeeze" occurs when the bands narrow significantly, indicating a period of low volatility. This contraction often precedes a period of increased volatility and a potential price breakout. The bands widen as volatility increases and contract as volatility decreases. The distance between the bands is determined by the standard deviation, which reflects the magnitude of price fluctuations. When the price touches or exceeds a band, it suggests that the price is relatively high or low on a statistical basis. A breakout above the upper band may suggest an overbought condition or the start of an uptrend, while a breakout below the lower band may suggest an oversold condition or the start of a downtrend.

Why Volatility Contraction Precedes Expansion

The phenomenon of volatility contraction preceding expansion is rooted in market dynamics. Periods of low volatility often indicate indecision or consolidation. However, this quiet period rarely lasts indefinitely. Eventually, a catalyst emerges – perhaps a news event, economic data release, or a shift in market sentiment – that triggers a significant price movement. The pent-up energy from the period of low volatility is then released, leading to a substantial expansion in price and volatility. Understanding this dynamic is key to anticipating potential trading opportunities.

Identifying the Setup

Pinpointing the exact moment to implement this strategy requires a keen eye and a structured approach. This includes confirming the squeeze conditions and assessing the RSI's position.

Conditions for a Valid Squeeze

Identifying a valid squeeze involves observing the narrowing of Bollinger Bands. There isn't a single, universally defined measurement for what constitutes a squeeze, but generally, it involves a significant reduction in the distance between the upper and lower bands relative to their historical averages. Traders often use the Bollinger Bandwidth indicator, which measures the percentage difference between the upper and lower bands, to quantify the squeeze. A squeeze is usually confirmed when the bandwidth falls below a specific threshold, which varies depending on the asset and timeframe being analyzed. Moreover, it's crucial to consider the context of the squeeze. A squeeze occurring after a prolonged uptrend might signal a consolidation before a continuation of the trend, while a squeeze after a downtrend could indicate a potential reversal.

RSI in Neutral → Overbought/Oversold Transition

The RSI component is crucial for validating the potential breakout direction. Ideally, the RSI should be transitioning from a neutral zone (around 50) towards either overbought (above 70) or oversold (below 30) levels as the price breaks out of the squeeze. If the RSI moves towards overbought territory concurrently with a breakout above the upper Bollinger Band, it reinforces the bullish signal. Conversely, if the RSI moves towards oversold territory as the price breaks below the lower band, it strengthens the bearish signal. It's essential to note that the RSI doesn't always perfectly align with the breakout. Sometimes, the RSI might lag slightly behind the price action. In such cases, waiting for confirmation in subsequent periods or using other trading indicators to confirm the signal is prudent.

Chart Example of Squeeze + RSI Divergence

Imagine a stock trading within a narrow range for several weeks, causing the Bollinger Bands to constrict tightly. The Bollinger Bandwidth indicator confirms the squeeze. During this period, the RSI hovers around the 50 level, indicating neutral momentum. Suddenly, positive news emerges about the company. The price breaks above the upper Bollinger Band, and simultaneously, the RSI surges above 70, entering overbought territory. This confirms the bullish breakout signal. Conversely, a stock might be trading sideways, creating a squeeze. Then, negative news hits, causing the price to break below the lower Bollinger Band. As this happens, the RSI drops below 30, indicating an oversold condition. This validates the bearish breakout signal. Visual examples are easily accessible on any charting software.

Entry & Exit Rules

Once the setup is identified, a clear set of entry and exit rules is paramount to execute the strategy effectively.

Entry When Price Breaks Upper/Lower Bollinger Band with RSI Confirmation

The entry point is triggered when the price decisively breaks either the upper or lower Bollinger Band, accompanied by confirmation from the RSI. For a bullish entry, the price must close above the upper band, and the RSI should be moving towards or already in overbought territory. For a bearish entry, the price must close below the lower band, and the RSI should be moving towards or already in oversold territory. The closure above or below the band provides initial confirmation of the breakout. It is crucial to observe the candlestick formation during the breakout. A strong, decisive candlestick close beyond the band is preferable to a weak or hesitant close. Some traders prefer to wait for a retest of the broken band as support (in a bullish scenario) or resistance (in a bearish scenario) before entering a position, aiming to improve their risk-reward ratio.

Setting Stop-Loss Below Squeeze Base

A prudent stop-loss order is essential to manage risk. In a bullish scenario, the stop-loss should be placed below the base of the squeeze, ideally just below the lower Bollinger Band during the squeeze period or a recent swing low. This placement protects against false breakouts and limits potential losses if the price reverses. Similarly, in a bearish scenario, the stop-loss should be placed above the base of the squeeze, typically just above the upper Bollinger Band during the squeeze period or a recent swing high. The rationale behind this placement is that if the price retraces back into the squeeze zone, the breakout is likely invalid, and the trade should be exited. The exact placement of the stop-loss can be adjusted based on individual risk tolerance and the specific characteristics of the asset being traded.

Profit Targets Based on ATR or Recent Swing Highs/Lows

Determining profit targets requires a careful assessment of market conditions and individual risk appetite. One approach is to use the Average True Range (ATR) to project potential price movement. For example, a trader might set a profit target that is two or three times the ATR distance from the entry price. This method is based on the assumption that the price will move a certain distance proportional to its average volatility. Another approach is to identify recent swing highs (in a bullish scenario) or swing lows (in a bearish scenario) and use these levels as potential profit targets. This strategy is based on the idea that the price is likely to encounter resistance at previous highs or support at previous lows. The choice of profit target strategy depends on the trader's risk tolerance, the asset being traded, and the overall market context. It is often beneficial to use a combination of these approaches to determine the most appropriate profit target.

Risk Management Tips

Effectively managing risk is as important as identifying profitable setups. Consider these tips to enhance the risk-adjusted returns of this strategy.

Filtering Signals with Volume or Candlestick Confirmation

Volume and candlestick patterns can provide valuable confirmation signals. An increase in volume during a breakout can validate the move, suggesting stronger conviction among traders. Conversely, a lack of volume during a breakout might indicate a false signal. Certain candlestick patterns, such as bullish engulfing patterns or bearish engulfing patterns, can also strengthen the breakout signal. Bullish engulfing patterns occurring near the upper Bollinger Band breakout can confirm the bullish momentum, while bearish engulfing patterns near the lower Bollinger Band breakout can confirm the bearish momentum. Filtering signals with volume and candlestick confirmation can help to reduce the number of false breakouts and improve the overall accuracy of the strategy.

Backtesting the Strategy Over Multiple Timeframes

Backtesting involves applying the strategy to historical data to assess its performance. This process helps to identify potential strengths and weaknesses of the strategy. It also allows traders to optimize the parameters of the strategy, such as the stop-loss and profit target levels. Backtesting should be conducted over multiple timeframes to evaluate the strategy's robustness. A strategy that performs well on one timeframe might not perform well on another. By backtesting over different timeframes, traders can identify the optimal timeframes for the strategy and adjust their trading accordingly. Moreover, it is crucial to backtest the strategy under different market conditions, such as bull markets, bear markets, and sideways markets.

Avoiding False Breakouts During News Events

News events can significantly impact market volatility and can lead to false breakouts. Economic data releases, company earnings announcements, and geopolitical events can all trigger sudden and unpredictable price movements. It is generally advisable to avoid trading during these periods or to reduce position sizes significantly. False breakouts are common during news events because the market is reacting to the news rather than following technical patterns. Traders who are unaware of upcoming news events are more likely to be caught in these false breakouts and suffer losses. Staying informed about upcoming news events and adjusting trading strategies accordingly is crucial for managing risk.

Conclusion

The combination of the Relative Strength Index and Bollinger Band squeeze offers a potent approach for identifying and capitalizing on mean reversion opportunities. The RSI provides insight into momentum, while Bollinger Bands highlight periods of consolidation and potential breakouts. By understanding the individual strengths of each indicator and combining them effectively, traders can enhance their ability to identify high-probability trading setups.

This strategy is most effective during periods of market consolidation, when prices are trading within a narrow range and volatility is low. During these times, the Bollinger Bands tend to narrow, creating a squeeze. The RSI can then be used to confirm the direction of the potential breakout. However, it is important to remember that no trading strategy is foolproof. False breakouts can occur, and market conditions can change rapidly. Therefore, it is crucial to implement strict risk management techniques and to continuously monitor the market.

Prior to deploying this strategy with real capital, it is strongly encouraged to test it thoroughly with a demo account. This allows traders to familiarize themselves with the strategy and to refine their trading skills without risking actual funds. Practice and experience are essential for mastering any trading strategy.

🤖 AI-Powered Trading Indicators

Win Up To 93% of Trades With the #1 Most Profitable Indicators

Unlock the power of artificial intelligence and take your trading to the next level. Our VIP Trading Indicators are designed to help you dominate any market — Forex, Crypto, Stocks — with up to 93% accuracy.

Gain instant 24/7 access to 5+ powerful, battle-tested indicators built to predict market trends with precision. Whether you're a beginner or an expert, these tools are optimized for all skill levels and work on any device.

✓ 30-Day Money Back Guarantee — Try Risk-Free!