Technical analysis provides a framework for evaluating securities and making informed trading decisions. One effective approach involves combining multiple trading indicators to filter signals and increase accuracy. The Renko Bollinger Bands strategy leverages the strengths of both tools to identify potential breakouts and capitalize on volatility shifts, enhancing traditional indicator-based strategies. Specifically, it uses the Renko chart to show the price movement with the use of bricks that filter out minor price variations, combined with Bollinger Bands, which visually represent volatility, this combination aims to pinpoint periods of consolidation followed by explosive price movement. The appearance of a Bollinger Band "squeeze," where the bands narrow significantly, often precedes a substantial price move. This narrowing indicates a period of low volatility, which historically leads to a breakout in either direction. Renko charts can also be used to identify trading opportunities when they are combined with other technical indicators.

Understanding the Tools

The Renko Bollinger Bands strategy is built upon two fundamental components: Renko charts and Bollinger Bands. Before delving into the specifics of the strategy, a review of each tool is essential.

Renko Charts: A Filtered View of Price Action

Unlike traditional time-based charts, Renko charts filter out minor price movements and display price changes as "bricks" of uniform size. A new brick is only plotted when the price moves a predetermined amount above or below the previous brick. This eliminates noise and provides a clearer picture of the underlying trend. This brick size is selected by the trader to reduce the noise and allow for easier identification of the main trends.

The primary advantage of Renko charts is their ability to highlight significant price trends while ignoring smaller fluctuations. This can be particularly useful in volatile markets where whipsaws and false signals are common. By focusing only on substantial price moves, Renko charts can help traders avoid being shaken out of their positions prematurely.

Bollinger Bands: Measuring Volatility

Bollinger Bands consist of a middle band, which is typically a simple moving average (SMA) of the price, and two outer bands that are plotted a certain number of standard deviations away from the middle band. These bands expand and contract based on market volatility. When volatility increases, the bands widen, and when volatility decreases, the bands narrow. Bollinger bands are a type of trading indicator.

The distance between the bands and the middle band is determined by the standard deviation of the price. This means that the bands automatically adjust to changing market conditions, providing a dynamic measure of volatility. Traders use Bollinger Bands to identify overbought and oversold conditions, as well as potential breakout points. Price typically oscillates within the bands, making moves outside of the bands notable events.

The Significance of a Bollinger Band "Squeeze"

A Bollinger Band "squeeze" occurs when the upper and lower bands narrow significantly, indicating a period of low volatility. This is a signal that the market is consolidating and preparing for a potential breakout. During a squeeze, the price action is typically confined within a tight range, as there is a balance between buying and selling pressure.

The rationale behind the squeeze is that periods of low volatility are often followed by periods of high volatility. This is because energy builds up during consolidation, and when a catalyst event occurs, the price is likely to make a substantial move. Traders look for squeezes as potential entry points, anticipating that the price will eventually break out of the range.

Why Volatility Contraction Precedes Expansion

Volatility contraction precedes expansion due to the fundamental dynamics of market activity. Periods of low volatility signify indecision or equilibrium between buyers and sellers. During these times, the price action is confined to a narrow range as neither side can overpower the other. This equilibrium cannot last indefinitely. Eventually, a catalyst, such as news event, earnings report, or a shift in market sentiment, will disrupt the balance. Once the catalyst emerges, the pent-up energy from the consolidation phase is released, leading to a sharp increase in volatility and a significant price movement. Therefore, identifying volatility contraction is a crucial step in anticipating potential breakouts and capturing profits from the subsequent expansion.

Identifying the Setup

To effectively implement the Renko Bollinger Bands strategy, it's crucial to identify the specific conditions that signal a valid setup. This involves looking for a combination of factors that suggest an imminent breakout.

Conditions for a Valid Squeeze

The primary condition for a valid squeeze is a noticeable narrowing of the Bollinger Bands. This can be visually assessed by observing the distance between the upper and lower bands. A squeeze is typically considered valid when the bandwidth, calculated as (Upper Band - Lower Band) / Middle Band, reaches a low value relative to its historical range. There is no single value to use that will fit all types of securities and that is why backtesting and observation is needed to identify the low bandwidth value for a trading setup. This indicates that volatility has contracted significantly and that the market is primed for a move.

It is also important to consider the duration of the squeeze. The longer the bands remain constricted, the more likely it is that a significant breakout will occur. However, a prolonged squeeze can also lead to false signals, so it's important to confirm the breakout with other indicators.

Confirming with Volume

An increase in volume during a price breakout is often seen as an indicator of the breakout's strength and validity. Volume represents the number of shares or contracts traded during a specific period. When a price breaks out of a consolidation pattern, such as a Bollinger Band squeeze, accompanied by a surge in volume, it suggests strong conviction among market participants. This increased trading activity confirms that the breakout is not just a random fluctuation but rather a genuine shift in market sentiment. A breakout with high volume indicates that a significant number of traders are participating in the move, which increases the likelihood of the breakout continuing in the same direction. Conversely, a breakout on low volume may be viewed with skepticism, as it could indicate a lack of conviction and a higher probability of the price reversing back into the previous range.

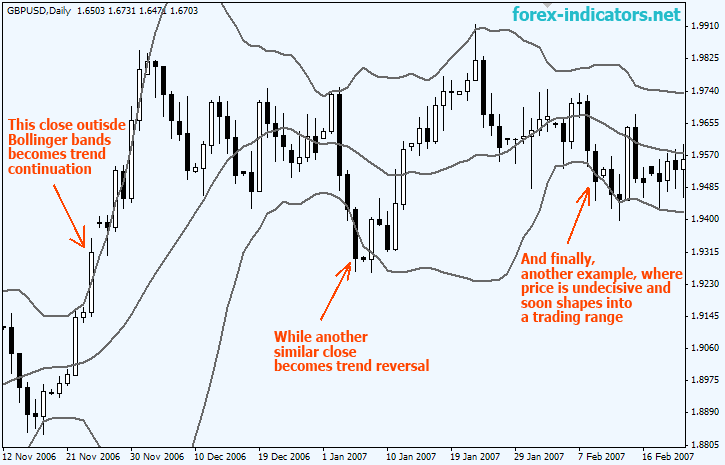

Chart Example of Squeeze

Imagine a Renko chart showing a stock trading sideways for several weeks. The Bollinger Bands have gradually narrowed, indicating a squeeze. A new Renko brick forms, breaking above the upper Bollinger Band. This breakout is confirmed by an increase in volume. This example illustrates how the Renko Bollinger Bands strategy can be used to identify potential breakout opportunities. The combination of Renko charts and Bollinger Bands provides a clear and concise view of price action, making it easier to spot potential trades.

Entry & Exit Rules

Once a valid squeeze has been identified, it's essential to have a clear set of rules for entering and exiting trades. This will help to ensure that trades are executed systematically and that profits are maximized while losses are minimized.

Entry When Price Breaks Upper/Lower Bollinger Band

The primary entry signal occurs when the price breaks above the upper Bollinger Band or below the lower Bollinger Band. This indicates that the breakout has begun and that the price is likely to continue moving in the direction of the breakout. The use of Renko bricks provides a confirmation tool that further reinforces the validity of the breakout.

For a bullish breakout, a long position is entered when a new Renko brick forms above the upper Bollinger Band. Conversely, for a bearish breakout, a short position is entered when a new Renko brick forms below the lower Bollinger Band. It's important to wait for the close of the brick before entering the trade to avoid being caught in a false breakout.

Setting Stop-Loss Below Squeeze Base

A stop-loss order is placed below the base of the squeeze to limit potential losses. The base of the squeeze is the lowest point reached during the consolidation period prior to the breakout. Placing the stop-loss below this level ensures that the trade is exited if the price reverses and breaks below the support level.

The exact placement of the stop-loss will depend on the volatility of the market and the trader's risk tolerance. A more conservative approach is to place the stop-loss slightly further away from the base of the squeeze to allow for some price fluctuation. A more aggressive approach is to place the stop-loss closer to the base to minimize potential losses. However, this may also increase the risk of being stopped out prematurely.

Profit Targets Based on Recent Swing Highs/Lows

Profit targets can be set based on various factors, such as recent swing highs or lows, Fibonacci levels, or a multiple of the trader's risk. One common approach is to set the profit target at the next significant level of resistance or support. Swing highs represent potential resistance levels in an uptrend, while swing lows represent potential support levels in a downtrend. By targeting these levels, traders can maximize their potential profits while still maintaining a reasonable probability of success.

Another approach is to use a fixed risk-reward ratio. For example, a trader might set a profit target that is two or three times the distance between the entry price and the stop-loss level. This ensures that the potential profit outweighs the potential loss, providing a favorable risk-reward profile. Traders should consider their own circumstances and trading plan when choosing a method for setting a profit target.

Risk Management Tips

Effective risk management is critical for long-term success in trading. The Renko Bollinger Bands strategy is no exception, and several techniques can be used to mitigate potential risks.

Filtering Signals with Volume or Candlestick Confirmation

One way to filter signals is to require confirmation from other indicators or chart patterns. For example, a breakout accompanied by a surge in volume is more likely to be a valid signal than a breakout with low volume. High volume indicates that there is strong conviction behind the move, increasing the likelihood that it will continue in the same direction.

Candlestick patterns can also provide confirmation of a breakout. For example, a bullish engulfing pattern that forms at the upper Bollinger Band can signal a strong buying pressure and increase the probability of a successful breakout.

Backtesting the Strategy Over Multiple Timeframes

Backtesting involves testing the strategy on historical data to evaluate its performance and identify any potential weaknesses. By backtesting the Renko Bollinger Bands strategy over multiple timeframes, traders can gain a better understanding of its strengths and limitations.

Backtesting can also help traders optimize the parameters of the strategy, such as the size of the Renko bricks and the number of standard deviations used for the Bollinger Bands. This can lead to improved performance and increased profitability.

Avoiding False Breakouts During News Events

News events can cause significant volatility in the market, leading to false breakouts and whipsaws. It's generally advisable to avoid trading during major news announcements, as the price action can be unpredictable and irrational. Traders who are already in a position should consider tightening their stop-loss orders or reducing their position size to protect their profits.

Another approach is to wait for the market to settle down after the news event before entering a new trade. This can help to avoid being caught in a false breakout and increase the probability of a successful trade.

Conclusion

The Renko Bollinger Bands strategy combines the strengths of both Renko charts and Bollinger Bands to identify potential breakout opportunities. By filtering out noise and focusing on significant price movements, Renko charts provide a clearer picture of the underlying trend. Bollinger Bands, on the other hand, measure volatility and identify periods of consolidation, which often precede significant price moves.

The strategy is most effective during periods of market consolidation, when the Bollinger Bands narrow significantly. By waiting for the price to break above the upper Bollinger Band or below the lower Bollinger Band, traders can enter trades in the direction of the breakout. Stop-loss orders should be placed below the base of the squeeze to limit potential losses, and profit targets can be set based on recent swing highs or lows, Fibonacci levels, or a multiple of the trader's risk.

Effective risk management is essential for long-term success with the Renko Bollinger Bands strategy. This includes filtering signals with volume or candlestick confirmation, backtesting the strategy over multiple timeframes, and avoiding false breakouts during news events. While many different technical indicators can be combined with Renko charts, the ones mentioned in this article can provide a good starting point for trading with the Renko chart in different markets.

As with any trading strategy, it's important to test the Renko Bollinger Bands strategy with a demo account before risking real capital. This will allow traders to become familiar with the strategy and fine-tune their approach before putting their own money on the line.

🤖 AI-Powered Trading Indicators

Win Up To 93% of Trades With the #1 Most Profitable Indicators

Unlock the power of artificial intelligence and take your trading to the next level. Our VIP Trading Indicators are designed to help you dominate any market — Forex, Crypto, Stocks — with up to 93% accuracy.

Gain instant 24/7 access to 5+ powerful, battle-tested indicators built to predict market trends with precision. Whether you're a beginner or an expert, these tools are optimized for all skill levels and work on any device.

✓ 30-Day Money Back Guarantee — Try Risk-Free!