In the realm of financial trading, a multitude of strategies are employed to identify profitable opportunities. Among these, indicator-based strategies stand out as a popular method for analyzing price movements and generating trade signals. The effectiveness of these strategies often lies in the synergy achieved by combining multiple indicators. One potent combination leverages the Relative Strength Index (RSI) and Bollinger Bands, particularly focusing on periods when a Bollinger Band "squeeze" occurs. This combination offers a potentially powerful approach to identify potential breakout trades.

Understanding the Tools

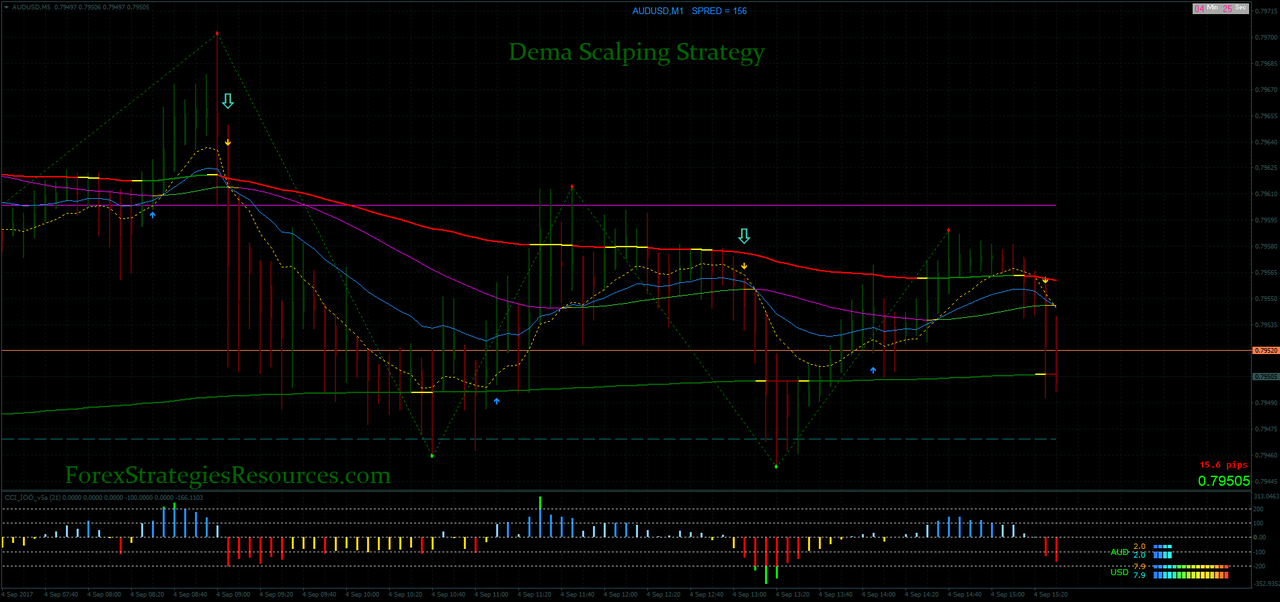

Before delving into the specifics of the DEMA Scalping strategy, it is crucial to establish a firm understanding of the key components involved: the Relative Strength Index (RSI) and Bollinger Bands.

Quick Refresher: What is RSI?

The Relative Strength Index (RSI) is a momentum indicator used in technical analysis. It measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. RSI values range from 0 to 100. Traditionally, RSI readings above 70 are considered overbought, suggesting the asset may be overvalued and due for a price correction. Conversely, RSI readings below 30 are considered oversold, indicating the asset may be undervalued and poised for a price increase. The RSI can also be used to identify divergences, where the price is making new highs or lows, but the RSI is not confirming these moves, which can signal potential trend reversals. As one of several trading indicators, the RSI is used to confirm a price trend and highlight possible turning points.

How Bollinger Bands Work and What a "Squeeze" Means

Bollinger Bands consist of a simple moving average (SMA) and two bands plotted at standard deviations above and below the SMA. These bands dynamically adjust to price volatility, widening during periods of high volatility and contracting during periods of low volatility. The "squeeze" refers to a period when the Bollinger Bands narrow significantly, indicating a decrease in volatility. This contraction often precedes a period of increased volatility and a potential price breakout. As a trading indicator, Bollinger Bands provide insights into both volatility and potential price targets.

Why Volatility Contraction Precedes Expansion

The principle behind the volatility contraction leading to expansion is rooted in market dynamics. Periods of low volatility are typically unsustainable. Market participants are generally indecisive during consolidation periods, resulting in a tight trading range. However, this indecision eventually resolves as buyers or sellers gain dominance, leading to a surge in volatility and a subsequent price movement. The Bollinger Band squeeze visually represents this period of suppressed volatility, signaling an imminent breakout. This is a very strong price action with two trading indicators. Traders look at this as a very good signal for possible profitable trades.

Identifying the Setup

The DEMA Scalping strategy focuses on identifying specific conditions that suggest a high probability of a successful breakout trade. These conditions involve both the Bollinger Band squeeze and the RSI.

Conditions for a Valid Squeeze

A valid squeeze is characterized by a significant narrowing of the Bollinger Bands. There is no universally agreed-upon definition of how narrow the bands must be, but generally, a period where the upper and lower bands are closer than their historical average width is considered a squeeze. Some traders use a specific percentage reduction in bandwidth as a criterion. The key is that the bands should be visibly constricting and price action should be consolidating.

RSI in Neutral → Overbought/Oversold Transition

For the DEMA Scalping strategy, the ideal scenario involves the RSI transitioning from a neutral level (around 50) towards overbought or oversold territory during the squeeze. If the price is expected to break upwards, the RSI should move from neutral towards overbought (above 70). Conversely, if the price is expected to break downwards, the RSI should move from neutral towards oversold (below 30). This movement in the RSI provides confirmation that momentum is building in the direction of the potential breakout. These are the best trading indicators.

Chart Example of Squeeze + RSI Divergence

Imagine a stock trading in a sideways range. The Bollinger Bands are visibly constricting, indicating a squeeze. Simultaneously, the RSI is oscillating around the 50 level. Suddenly, the price begins to inch upwards, and the RSI starts to climb towards 70. This combination of a Bollinger Band squeeze and an RSI moving towards overbought conditions suggests a potential bullish breakout. Alternatively, consider a scenario where the price is consolidating within the squeeze, but the RSI begins to decline towards

30. This indicates a potential bearish breakout. A chart example showcasing this scenario would clearly illustrate the confluence of the squeeze and RSI movement, providing a visual confirmation of the setup.

Entry & Exit Rules

Once a valid setup is identified, the next step involves establishing clear entry and exit rules to manage risk and maximize potential profits.

Entry When Price Breaks Upper/Lower Bollinger Band with RSI Confirmation

The entry signal for the DEMA Scalping strategy is triggered when the price breaks above the upper Bollinger Band (for a long position) or below the lower Bollinger Band (for a short position), and this breakout is confirmed by the RSI. For a long entry, the RSI should be moving towards or already in overbought territory. For a short entry, the RSI should be moving towards or already in oversold territory. The breakout should be decisive, with the price closing beyond the band. This approach utilizes trading indicators to identify a trading opportunity.

Setting Stop-Loss Below Squeeze Base

A crucial aspect of risk management is setting a stop-loss order to limit potential losses. In the DEMA Scalping strategy, the stop-loss is typically placed below the base of the squeeze. For a long position, the stop-loss would be placed slightly below the lowest price reached during the squeeze. For a short position, the stop-loss would be placed slightly above the highest price reached during the squeeze. This placement aims to protect the position from false breakouts while allowing the trade sufficient room to develop.

Profit Targets Based on ATR or Recent Swing Highs/Lows

Determining appropriate profit targets is essential for successful implementation of the strategy. Several methods can be used to set profit targets, including using the Average True Range (ATR) or identifying recent swing highs and lows. The ATR provides a measure of market volatility and can be used to project potential price movements. A common approach is to set a profit target equal to one or two times the ATR. Alternatively, traders can identify recent swing highs (for long positions) or swing lows (for short positions) and use these levels as potential profit targets. The choice of method depends on the individual trader's risk tolerance and trading style.

Risk Management Tips

Effective risk management is paramount to the long-term success of any trading strategy. The DEMA Scalping strategy is no exception. Several techniques can be employed to mitigate risk and improve the probability of profitable trades.

Filtering Signals with Volume or Candlestick Confirmation

To avoid false breakouts, it is beneficial to filter signals using volume or candlestick patterns. A breakout accompanied by high volume is generally considered more reliable than a breakout with low volume. High volume suggests strong participation from market participants, lending credence to the breakout. Candlestick patterns can also provide confirmation of the breakout. For example, a bullish engulfing pattern following a breakout above the upper Bollinger Band can strengthen the signal. As two of the better known trading indicators, price action analysis and volume can improve overall profitability.

Backtesting the Strategy Over Multiple Timeframes

Before implementing the DEMA Scalping strategy with real capital, it is crucial to backtest the strategy over multiple timeframes. Backtesting involves applying the strategy to historical data to assess its performance and identify potential weaknesses. This process allows traders to optimize the strategy's parameters and develop a better understanding of its strengths and limitations. Different timeframes may yield different results, so it is important to test the strategy on the timeframe that aligns with the trader's trading style.

Avoiding False Breakouts During News Events

Economic news events can significantly impact market volatility and lead to false breakouts. It is advisable to avoid trading the DEMA Scalping strategy during major news releases, as the sudden surge in volatility can trigger premature entry or exit signals. A more prudent approach is to wait for the market to stabilize after the news event before resuming trading. Monitoring an economic calendar is very important when scalping these particular trading indicators.

Conclusion

The DEMA Scalping strategy, which is a trading strategy that combines the power of the Relative Strength Index (RSI) and Bollinger Bands, offers a potentially effective approach to identifying and capitalizing on breakout trades. By focusing on periods of Bollinger Band squeeze and monitoring the RSI for momentum confirmation, traders can identify high-probability setups. However, it is crucial to remember that no strategy is foolproof, and effective risk management is essential for long-term success.

This strategy is particularly effective during periods of market consolidation, when price action is confined to a narrow range. The Bollinger Band squeeze provides a visual indication of this consolidation, while the RSI helps to identify the direction of the potential breakout. The use of trading indicators such as the RSI and Bollinger Bands can be applied to many different approaches.

It is highly recommended that any individual interested in implementing the DEMA Scalping strategy thoroughly test the strategy on a demo account before risking real capital. This allows traders to gain experience with the strategy, fine-tune its parameters, and develop a deeper understanding of its nuances.

🤖 AI-Powered Trading Indicators

Win Up To 93% of Trades With the #1 Most Profitable Indicators

Unlock the power of artificial intelligence and take your trading to the next level. Our VIP Trading Indicators are designed to help you dominate any market — Forex, Crypto, Stocks — with up to 93% accuracy.

Gain instant 24/7 access to 5+ powerful, battle-tested indicators built to predict market trends with precision. Whether you're a beginner or an expert, these tools are optimized for all skill levels and work on any device.

✓ 30-Day Money Back Guarantee — Try Risk-Free!