Successful market participation frequently requires the strategic combination of various analysis methods. Relying on a single metric can often lead to inadequate decision-making, emphasizing the need for confluence. This article explores a potent confluence strategy that combines the Relative Strength Index (RSI) with Bollinger Bands to identify high-probability trading opportunities. The synergy between these indicators provides a comprehensive view of price momentum and volatility, enhancing the accuracy of trade entries and exits. This combination can be a valuable asset in any trader's toolkit, helping to navigate the complexities of financial markets. Examining the rationale behind this indicator pairing is crucial for informed decision-making.

Understanding the Tools

Before diving into the strategy, it is essential to understand the individual components: the Relative Strength Index (RSI) and Bollinger Bands. Each of these trading indicators offers unique insights into price behavior, and their combined use can generate powerful signals. A solid grasp of these foundational tools is the first step towards effectively implementing this strategy.

Quick Refresher: What is RSI?

The Relative Strength Index (RSI) is a momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. It is primarily used to identify potential trend reversals. RSI values range from 0 to 100. Traditionally, an RSI above 70 is considered overbought, suggesting that the asset may be overvalued and due for a price correction. Conversely, an RSI below 30 is considered oversold, indicating that the asset may be undervalued and poised for a potential price increase.

The RSI's calculations involve comparing average gains to average losses over a specified period, usually 14 periods. This allows traders to gauge the strength of a trend and anticipate possible changes. A rising RSI typically accompanies an upward trend, while a falling RSI suggests a downward trend. However, it is crucial to note that RSI is most effective when used in conjunction with other trading indicators and analysis techniques.

- Overbought Condition: RSI value above 70, signaling potential price decrease.

- Oversold Condition: RSI value below 30, signaling potential price increase.

- Calculation: Based on average gains and losses over a set period.

How Bollinger Bands Work and What a “Squeeze” Means

Bollinger Bands are a volatility indicator developed by John Bollinger. They consist of a simple moving average (SMA) and two bands plotted at a standard deviation above and below the SMA. The bands dynamically widen and narrow as volatility increases and decreases.

The standard Bollinger Band setup uses a 20-period SMA, with the upper and lower bands typically set at two standard deviations from the SMA. These bands serve as dynamic support and resistance levels. When price action consistently touches or exceeds the upper band, it suggests that the market is overbought. Conversely, when price action consistently touches or dips below the lower band, it suggests that the market is oversold.

A “squeeze” occurs when the Bollinger Bands narrow significantly, indicating a period of low volatility. This usually happens when the market is consolidating or trading within a tight range. Traders often view a squeeze as a precursor to a substantial price movement. The rationale is that low volatility periods are unsustainable, and the market will eventually break out in one direction or the other. The direction of the breakout is not always predictable, which is why combining Bollinger Bands with other technical analysis tools like RSI is crucial.

- Components: Simple Moving Average (SMA) and two bands at a standard deviation.

- Function: Dynamically adjust to volatility, acting as support and resistance.

- "Squeeze": Narrowing of bands indicates low volatility, often preceding a significant price move.

Why Volatility Contraction Precedes Expansion

The principle that volatility contraction precedes expansion is a cornerstone of trading based on Bollinger Bands and other volatility indicators. This phenomenon occurs because periods of low volatility represent market equilibrium, where neither buyers nor sellers are in control. This equilibrium cannot last indefinitely; eventually, an external catalyst or an imbalance in buying and selling pressure will trigger a breakout.

When volatility is low, market participants are generally indecisive, and price movements are muted. This indecision leads to a build-up of potential energy, similar to a compressed spring. As the market remains in this state, the potential for a significant move increases. When the breakout finally occurs, it is often swift and powerful, as the market seeks to establish a new equilibrium.

Understanding this dynamic is crucial for traders because it provides a framework for anticipating potential trading opportunities. By identifying periods of volatility contraction, traders can prepare for the eventual expansion and position themselves to profit from the resulting price movement. However, it is essential to combine this knowledge with other trading indicators to determine the likely direction of the breakout.

Identifying the Setup

Identifying a profitable trading setup using the confluence of the Relative Strength Index (RSI) and Bollinger Bands requires a keen eye and a thorough understanding of market dynamics. Specific conditions must be met to validate the setup and increase the probability of a successful trade. This section outlines the criteria for identifying a valid squeeze in conjunction with RSI signals.

Conditions for a Valid Squeeze

The primary condition for a valid squeeze is the noticeable narrowing of the Bollinger Bands. This is visually identified when the upper and lower bands move closer to the Simple Moving Average (SMA), indicating a decrease in market volatility. There are several ways to quantify this narrowing:

One approach is to measure the distance between the upper and lower bands and compare it to historical data. A significant reduction in this distance compared to the average distance over a specific period confirms the squeeze.

Another method involves calculating the Bollinger Bandwidth, which is the difference between the upper and lower bands divided by the middle band (SMA). A lower Bollinger Bandwidth value signifies a tighter squeeze.

In addition to the narrowing of the bands, it is important to observe the price action during the squeeze. Ideally, the price should be consolidating within a tight range, exhibiting minimal fluctuations. This further reinforces the idea that the market is in a state of equilibrium, preparing for a breakout.

- Band Narrowing: Visible convergence of upper and lower Bollinger Bands.

- Quantifiable Metrics: Reduced band distance compared to historical averages.

- Price Consolidation: Price action confined within a tight range.

RSI in Neutral → Overbought/Oversold Transition

Once a valid squeeze has been identified, the next step is to analyze the Relative Strength Index (RSI) for potential entry signals. The most effective setups occur when the RSI transitions from a neutral state (around 50) to either overbought (above 70) or oversold (below 30) territory.

A transition to overbought territory suggests that the market is gaining upward momentum and is likely to break out to the upside. Conversely, a transition to oversold territory indicates increasing downward momentum and a potential breakout to the downside.

The key is to look for a clear and decisive move by the RSI, rather than a gradual drift. A sharp spike in the RSI towards overbought or oversold levels provides a stronger confirmation of the impending breakout.

Furthermore, divergence between the RSI and price action can provide additional confirmation. For example, if the price is making higher highs during the squeeze, but the RSI is making lower highs, this bearish divergence suggests that the breakout is likely to be to the downside. Conversely, if the price is making lower lows, but the RSI is making higher lows, this bullish divergence indicates a potential upside breakout.

- Neutral to Extreme: RSI moving from around 50 to above 70 (overbought) or below 30 (oversold).

- Sharp Movement: A decisive spike in RSI provides stronger confirmation.

- Divergence: RSI divergence with price action for added confirmation.

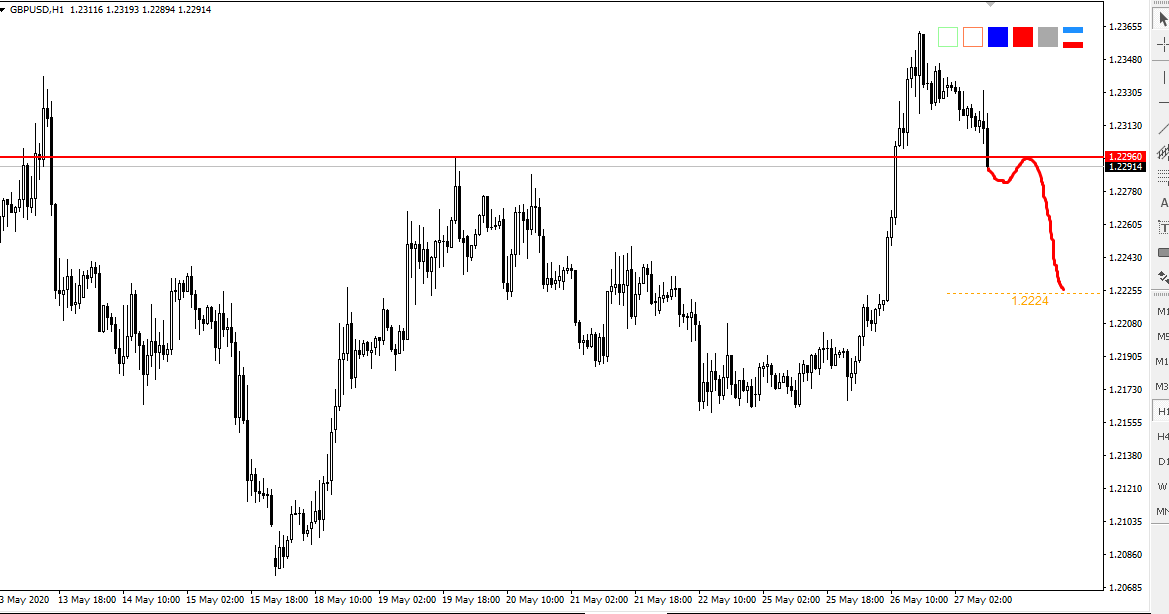

Chart Example of Squeeze + RSI Divergence

A practical example can illustrate the power of combining a Bollinger Band squeeze with RSI divergence. Imagine a stock trading in a sideways range for several weeks, with the Bollinger Bands visibly narrowing. The price action is choppy but generally confined within the bands.

As the squeeze progresses, the RSI fluctuates around the 50 level, indicating a neutral market sentiment. However, as the price approaches the upper band, it makes a new high, while the RSI fails to make a corresponding higher high. This bearish divergence signals that the upward momentum is weakening, despite the price reaching new highs.

Shortly after the RSI divergence, the price breaks below the lower Bollinger Band, confirming the downside breakout. Traders who recognized the squeeze and the RSI divergence would have been well-positioned to enter a short trade at this point, with a high probability of success.

This example highlights the importance of not only identifying the squeeze but also paying attention to the RSI and looking for divergence signals. The combination of these factors can significantly increase the accuracy of trading decisions.

Entry & Exit Rules

Establishing clear entry and exit rules is paramount for any trading strategy's success. These rules dictate when to initiate a trade, where to set stop-loss orders to manage risk, and where to take profits to maximize potential returns. The following guidelines outline a structured approach to entering and exiting trades based on the RSI and Bollinger Band squeeze strategy.

Entry When Price Breaks Upper/Lower Bollinger Band with RSI Confirmation

The primary entry signal for this strategy is a breakout from the squeeze, confirmed by the Relative Strength Index (RSI). Specifically, a trade is entered when the price breaks either the upper or lower Bollinger Band, and the RSI supports the direction of the breakout.

If the price breaks above the upper Bollinger Band, indicating a potential upside breakout, the RSI should be in overbought territory (above 70) or trending towards it. This confirms that the market has strong upward momentum. Conversely, if the price breaks below the lower Bollinger Band, suggesting a downside breakout, the RSI should be in oversold territory (below 30) or moving in that direction.

It is crucial to wait for a confirmed breakout before entering a trade. A confirmed breakout occurs when the price closes outside the Bollinger Band, indicating that the move is likely to sustain. Avoid entering a trade based on a temporary spike that quickly reverses back inside the bands.

- Breakout Confirmation: Price closes outside the upper or lower Bollinger Band.

- RSI Alignment: RSI confirms the direction of the breakout (overbought for upside, oversold for downside).

- Avoid False Signals: Wait for a confirmed breakout, not just a temporary spike.

Setting Stop-Loss Below Squeeze Base

Proper risk management is essential for protecting trading capital. One of the most effective ways to manage risk is by setting a stop-loss order. A stop-loss order is an instruction to automatically close a trade if the price moves against the trader's position by a specified amount.

In the context of this strategy, the stop-loss order should be placed below the base of the squeeze. The base of the squeeze is the lowest point reached during the consolidation period before the breakout. This level represents a significant support area, and a break below it would invalidate the trade setup.

For long trades (entries above the upper Bollinger Band), the stop-loss order should be placed slightly below the lowest point of the squeeze. This provides a buffer against minor price fluctuations while still protecting against significant losses. For short trades (entries below the lower Bollinger Band), the stop-loss order should be placed slightly above the highest point of the squeeze.

- Placement: Stop-loss order below the base of the squeeze.

- Long Trades: Stop-loss slightly below the lowest point of the squeeze.

- Short Trades: Stop-loss slightly above the highest point of the squeeze.

Profit Targets Based on ATR or Recent Swing Highs/Lows

Once a trade has been entered and a stop-loss order has been set, the next step is to determine profit targets. Profit targets are predetermined levels at which a trader intends to close the trade and realize a profit.

One approach to setting profit targets is to use the Average True Range (ATR) indicator. The ATR measures the average range of price movement over a specified period. By multiplying the ATR value by a certain factor (e.g., 1.5 or 2), traders can estimate the potential price movement after the breakout. The profit target can then be set at this distance from the entry price.

Another method involves using recent swing highs and lows as potential profit targets. Swing highs are the highest points reached in a price uptrend, while swing lows are the lowest points reached in a price downtrend. These levels often act as areas of resistance or support, and the price may stall or reverse when it reaches them. Therefore, setting profit targets near these levels can be a prudent approach.

- ATR Method: Multiply the Average True Range (ATR) by a factor to estimate potential price movement.

- Swing Highs/Lows: Use recent swing highs (for short trades) and swing lows (for long trades) as targets.

- Adaptability: Adjust profit targets based on market conditions and individual risk tolerance.

Risk Management Tips

Effective risk management is the cornerstone of successful trading. No strategy, regardless of its theoretical edge, can guarantee profits. Proper risk management techniques are essential for mitigating potential losses and preserving trading capital. This section outlines several risk management tips to enhance the RSI and Bollinger Band squeeze strategy.

Filtering Signals with Volume or Candlestick Confirmation

One way to improve the reliability of trading signals is to filter them using additional confirmation techniques. Volume analysis and candlestick patterns can provide valuable insights into the strength of a potential breakout.

Volume analysis involves examining the trading volume accompanying the price breakout. A strong breakout should be accompanied by a significant increase in volume, indicating strong participation from market participants. If the breakout occurs on low volume, it may be a false signal and should be approached with caution.

Candlestick patterns can also provide confirmation of the breakout. For example, a bullish engulfing pattern or a piercing pattern near the upper Bollinger Band can confirm an upside breakout. Conversely, a bearish engulfing pattern or a dark cloud cover pattern near the lower Bollinger Band can confirm a downside breakout.

- Volume Confirmation: Look for increased volume during breakouts.

- Candlestick Patterns: Bullish or bearish patterns near Bollinger Bands can confirm breakout direction.

- Signal Quality: Filter out low-volume breakouts or those lacking candlestick confirmation.

Backtesting the Strategy Over Multiple Timeframes

Backtesting is the process of evaluating a trading strategy by applying it to historical data. This allows traders to assess the strategy's performance over different market conditions and time periods. Backtesting is an essential step in validating a trading strategy and identifying its strengths and weaknesses.

When backtesting the RSI and Bollinger Band squeeze strategy, it is crucial to test it over multiple timeframes. Different timeframes can reveal different patterns and trends, and a strategy that works well on one timeframe may not be as effective on another.

By backtesting the strategy on various timeframes, traders can gain a better understanding of its overall effectiveness and identify the timeframes where it performs best. This information can then be used to refine the strategy and optimize its parameters for specific market conditions.

- Historical Data: Apply the strategy to historical price data.

- Multiple Timeframes: Test the strategy on various timeframes (e.g., 15-minute, hourly, daily).

- Performance Analysis: Identify strengths, weaknesses, and optimal timeframes.

Avoiding False Breakouts During News Events

News events can significantly impact financial markets, often leading to increased volatility and unpredictable price movements. Trading during news events can be risky, as false breakouts are common.

To mitigate this risk, it is advisable to avoid trading the RSI and Bollinger Band squeeze strategy during major news announcements, particularly those related to economic data or geopolitical events. These events can trigger sudden and erratic price swings that invalidate the trading setup.

One approach is to consult an economic calendar and be aware of upcoming news releases. Avoid entering trades in the hour leading up to and following major news events. If a trade is already open, consider closing it before the news release to avoid being caught in a false breakout.

- Economic Calendar: Monitor upcoming news events.

- Pre- and Post-Event Avoidance: Avoid trading one hour before and after major news releases.

- Existing Trade Management: Consider closing open trades before news events to avoid false breakouts.

Conclusion

In summary, the combination of the Relative Strength Index (RSI) and Bollinger Bands offers a potent approach to identifying trading opportunities. By understanding and applying the concepts of volatility contraction, momentum confirmation, and risk management, traders can enhance their chances of success in the financial markets. The confluence of these indicators provides a comprehensive view of price action, allowing for more informed decision-making.

Summary of the Combined Power of RSI + BB Squeeze

The synergy between the RSI and Bollinger Band squeeze strategy lies in its ability to identify periods of market consolidation and anticipate potential breakouts. The Bollinger Bands provide insights into market volatility, while the RSI measures the strength of price momentum.

When the Bollinger Bands narrow, indicating a squeeze, it signals that the market is in a state of equilibrium, preparing for a significant price move. The RSI then helps to determine the likely direction of the breakout by identifying overbought or oversold conditions.

By combining these two indicators, traders can filter out false signals and increase the probability of successful trades. The strategy is particularly effective when used in conjunction with other technical analysis techniques, such as volume analysis and candlestick patterns.

When This Strategy is Most Effective (e.g., During Market Consolidation)

This strategy is most effective during periods of market consolidation, when the price is trading within a tight range and volatility is low. These conditions are conducive to the formation of Bollinger Band squeezes, which are the foundation of the strategy.

The strategy is less effective during strong trending markets, where the price is constantly moving in one direction. In these conditions, the Bollinger Bands may not narrow significantly, and the RSI may remain consistently in overbought or oversold territory, making it difficult to identify reliable entry signals.

Therefore, it is important to be selective in applying this strategy and to focus on market conditions that are conducive to its success. Identifying periods of consolidation and patiently waiting for the right setup is key to maximizing its effectiveness.

Encouragement to Test with a Demo Account

Before implementing any new trading strategy, it is essential to test it thoroughly using a demo account. A demo account allows traders to practice trading with virtual funds in a simulated market environment. This provides a safe and risk-free way to evaluate the strategy's performance and gain experience in applying it.

Testing the RSI and Bollinger Band squeeze strategy on a demo account allows traders to become familiar with the setup, entry and exit rules, and risk management techniques. It also provides an opportunity to identify any potential weaknesses in the strategy and refine its parameters before risking real capital.

Once traders have gained confidence in the strategy and have demonstrated consistent profitability on a demo account, they can then consider implementing it with real funds. However, it is important to start with a small amount of capital and gradually increase the position size as the strategy proves itself.

🤖 AI-Powered Trading Indicators

Win Up To 93% of Trades With the #1 Most Profitable Indicators

Unlock the power of artificial intelligence and take your trading to the next level. Our VIP Trading Indicators are designed to help you dominate any market — Forex, Crypto, Stocks — with up to 93% accuracy.

Gain instant 24/7 access to 5+ powerful, battle-tested indicators built to predict market trends with precision. Whether you're a beginner or an expert, these tools are optimized for all skill levels and work on any device.

✓ 30-Day Money Back Guarantee — Try Risk-Free!