Navigating financial markets demands a robust strategy, and many traders rely on indicator-based methodologies to pinpoint opportunities and manage risk. The Average Directional Index Slope, or ADX Slope, stands as a valuable tool in a trader's arsenal. It helps assess the strength and direction of a trend, assisting in informed choices about entries, exits, and overall strategy. The ADX Slope is a momentum indicator that complements other trading tools.

Understanding the ADX Indicator

The ADX, or Average Directional Index, is a technical indicator used in trading to measure the strength of a trend. It is not directional; instead, it quantifies the intensity of a trend, regardless of whether it is upward or downward. Developed by J. Welles Wilder Jr., it is displayed as a single line that oscillates between 0 and 100. Readings above 25 generally suggest a strong trend, while readings below 20 indicate a weak or non-existent trend. It is one of several useful Trading Indicators that traders utilize.

Deciphering the ADX Slope

The ADX Slope analyzes the rate of change of the ADX line itself. A rising ADX Slope suggests that the trend strength is increasing, while a falling ADX Slope implies that the trend is weakening. By monitoring the slope, traders can gain insight into whether a trend is gaining momentum or losing steam.

Calculating the ADX Slope

Calculating the ADX Slope involves a few steps:

- Calculate the ADX using its standard formula (typically over a 14-period timeframe).

- Determine the slope by measuring the change in ADX values over a specified period (e.g., the difference between the current ADX and the ADX value 'n' periods ago).

- Plot the slope as a line or histogram, often alongside the ADX line.

Interpreting ADX Slope Signals

The ADX Slope provides several valuable signals for traders:

- Increasing Slope: Indicates that the current trend is gaining strength and is likely to continue.

- Decreasing Slope: Suggests that the current trend is weakening and may be nearing its end.

- Slope Crossover: A crossover of the ADX Slope above a certain threshold can be interpreted as a buy signal in an uptrend, or a sell signal in a downtrend.

- Divergence: When the price of an asset makes new highs but the ADX Slope fails to do so, it could signal a potential trend reversal.

Combining ADX Slope with Other Indicators

The ADX Slope can be used in conjunction with other trading indicators to improve the accuracy of signals. Here are a few examples:

- Moving Averages: Confirmation of a trend by a moving average crossover combined with an increasing ADX Slope can provide a strong signal.

- Relative Strength Index (RSI): RSI can identify overbought or oversold conditions. If RSI signals overbought while the ADX Slope starts to decline, it could indicate a potential reversal.

- Moving Average Convergence Divergence (MACD): MACD can identify trend direction and momentum. When MACD confirms a trend and the ADX Slope is increasing, it strengthens the validity of the trend.

Implementing ADX Slope in a Trading Strategy

Here's a step-by-step guide to implementing ADX Slope in a trading strategy:

- Identify a Trend: Use moving averages or other trend-following indicators to identify the overall trend direction.

- Confirm Trend Strength: Use the ADX to confirm the strength of the identified trend. Look for ADX values above 25 to indicate a strong trend.

- Monitor the ADX Slope: Observe the ADX Slope for changes in trend strength. A rising slope suggests increasing strength, while a falling slope indicates weakening strength.

- Generate Trading Signals: Based on the ADX Slope, generate buy or sell signals. For example, enter long positions when the trend is up, the ADX is above 25, and the ADX Slope is increasing. Enter short positions when the trend is down, the ADX is above 25, and the ADX Slope is increasing.

- Set Stop-Loss Orders: Place stop-loss orders to limit potential losses. A common strategy is to place stop-loss orders below recent swing lows for long positions, and above recent swing highs for short positions.

- Define Profit Targets: Set profit targets based on support and resistance levels, Fibonacci extensions, or other technical analysis techniques.

- Manage Risk: Always manage risk by limiting the amount of capital risked on each trade. A general rule of thumb is to risk no more than 1-2% of total capital per trade.

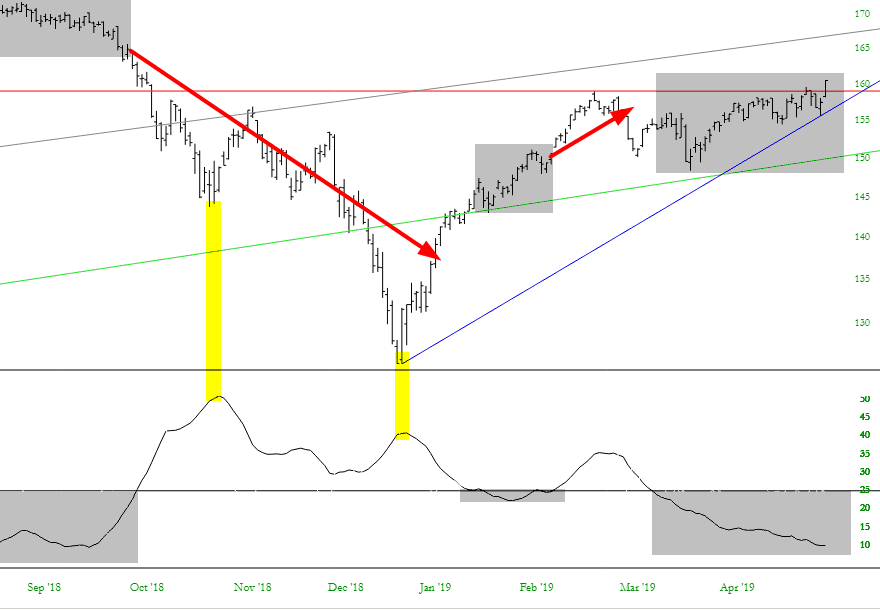

Example Trade Setup Using ADX Slope

Consider a scenario where a stock is trending upward. The 50-day moving average is above the 200-day moving average, confirming an uptrend. The ADX is above 25, indicating a strong trend. The ADX Slope is rising, suggesting that the uptrend is gaining momentum. A trader might enter a long position, placing a stop-loss order below a recent swing low and setting a profit target based on the next resistance level.

Advantages of Using ADX Slope

Using ADX Slope offers several advantages:

- Early Identification of Trend Changes: The ADX Slope can help traders identify potential trend reversals before they occur.

- Improved Signal Accuracy: Combining ADX Slope with other indicators can improve the accuracy of trading signals.

- Enhanced Risk Management: By monitoring trend strength, traders can better manage risk by adjusting position sizes and stop-loss orders.

Limitations of ADX Slope

Like any indicator, ADX Slope has limitations:

- Lagging Indicator: The ADX Slope is a lagging indicator, which means it may not provide signals in real-time.

- False Signals: The ADX Slope can generate false signals, especially in volatile markets.

- Requires Confirmation: It's essential to confirm ADX Slope signals with other indicators and technical analysis techniques.

Optimizing ADX Slope Parameters

The default parameters for ADX (typically 14 periods) and the slope calculation period can be adjusted to suit different trading styles and market conditions. Experimenting with different settings through backtesting can help identify the optimal parameters for a particular asset or market.

Backtesting ADX Slope Strategies

Before implementing an ADX Slope strategy with real capital, it's crucial to backtest the strategy on historical data. Backtesting involves applying the strategy to past market data to assess its performance and identify potential weaknesses. This can help refine the strategy and improve its profitability.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using the ADX Slope:

- Relying Solely on ADX Slope: Do not rely solely on the ADX Slope for trading decisions. Always confirm signals with other indicators and technical analysis techniques.

- Ignoring Market Con Consider the overall market context, including economic news and events, before making trading decisions based on ADX Slope signals.

- Overtrading: Avoid overtrading based on ADX Slope signals. Be selective and only trade when the signals are strong and well-confirmed.

Advanced ADX Slope Techniques

Experienced traders can use advanced techniques to further enhance the effectiveness of the ADX Slope. Some advanced techniques include:

- Combining ADX Slope with Fibonacci Retracements: Use Fibonacci retracements to identify potential support and resistance levels, and use the ADX Slope to confirm trend strength near these levels.

- Using ADX Slope to Identify Breakouts: Monitor the ADX Slope as the price approaches a key resistance level. A rising ADX Slope can confirm the breakout.

- Integrating ADX Slope with Volume Analysis: Combine ADX Slope signals with volume analysis to further confirm trend strength. For example, an increasing ADX Slope accompanied by rising volume suggests a strong and sustainable trend.

ADX Slope for Different Markets

The ADX Slope can be applied to various markets, including:

- Stocks: Identifying strong trending stocks for potential long or short positions.

- Forex: Confirming trend strength in currency pairs.

- Commodities: Analyzing trend strength in commodities such as oil, gold, and silver.

- Cryptocurrencies: Assessing trend strength in volatile cryptocurrencies like Bitcoin and Ethereum.

Psychology of ADX Slope Trading

Trading with the ADX Slope, like any strategy, requires a disciplined and patient approach. Traders should be prepared to accept losses and avoid emotional decision-making. Sticking to a well-defined trading plan and managing risk effectively are crucial for long-term success.

The Role of Risk Management

Proper risk management is paramount when trading with the ADX Slope. This includes setting stop-loss orders, limiting position sizes, and avoiding over-leveraging. It's essential to only risk capital that can be afforded to lose and to diversify investments to reduce overall risk.

Future Trends in ADX Slope Analysis

The ADX Slope is likely to continue evolving as trading technology advances. Future trends may include:

- Integration with Artificial Intelligence: Using AI to analyze ADX Slope patterns and generate more accurate trading signals.

- Development of Automated Trading Systems: Creating automated trading systems that use ADX Slope to execute trades automatically.

- Incorporation of Sentiment Analysis: Combining ADX Slope analysis with sentiment analysis to gain a more comprehensive understanding of market trends.

Conclusion

The ADX Slope is a valuable tool for assessing the strength and direction of trends in financial markets. By understanding its principles, combining it with other indicators, and implementing proper risk management, traders can enhance their decision-making and improve their trading performance. While the ADX Slope has limitations, its advantages, especially when used as part of a comprehensive strategy, make it a valuable asset for informed choices. As markets evolve, continued learning and adaptation are essential to maximizing the effectiveness of this Trading Indicator.

🤖 AI-Powered Trading Indicators

Win Up To 93% of Trades With the #1 Most Profitable Indicators

Unlock the power of artificial intelligence and take your trading to the next level. Our VIP Trading Indicators are designed to help you dominate any market — Forex, Crypto, Stocks — with up to 93% accuracy.

Gain instant 24/7 access to 5+ powerful, battle-tested indicators built to predict market trends with precision. Whether you're a beginner or an expert, these tools are optimized for all skill levels and work on any device.

✓ 30-Day Money Back Guarantee — Try Risk-Free!