In the realm of financial markets, where price fluctuations are constant, traders are always searching for reliable tools and strategies. Strategies based on trading indicators offer a structured approach to analyzing market data and identifying potential opportunities. One such approach involves the integration of the Relative Strength Index (RSI) with Bollinger Bands, a methodology that aims to capture moments of significant price movement following periods of consolidation. When combined, these indicators can provide valuable insight into market dynamics. This strategy attempts to capitalize on the tendency for volatility to expand after periods of contraction, potentially leading to profitable trades.

Understanding the Tools

To effectively employ any indicator-based strategy, a firm understanding of the individual components is required. This section provides a succinct overview of RSI and Bollinger Bands, highlighting their individual functionalities and how they contribute to the overall strategy.

Quick Refresher: What is RSI?

The Relative Strength Index (RSI) is a momentum indicator used to assess the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. It is displayed as an oscillator and can have a value from 0 to 100. Generally, RSI values above 70 suggest that an asset is overbought and may be poised for a price reversal or corrective pullback. Conversely, RSI values below 30 suggest that an asset is oversold and may be due for a price increase.

The RSI is calculated using the following formula:

RSI = 100 - [100 / (1 + (Average Gain / Average Loss))]

The "Average Gain" and "Average Loss" are calculated over a specified period, typically 14 periods. These calculations smooth the data and reduce the impact of short-term price fluctuations. While the default period is often 14, traders can adjust this parameter to suit their individual preferences and trading styles. Shorter periods will result in a more sensitive RSI, while longer periods will create a smoother RSI.

How Bollinger Bands Work and What a “Squeeze” Means

Bollinger Bands consist of three lines plotted on a price chart: a middle band, an upper band, and a lower band. The middle band is typically a simple moving average (SMA) of the price over a specified period, commonly 20 periods. The upper and lower bands are plotted at a certain number of standard deviations above and below the middle band. A common setting is two standard deviations, which means that approximately 95% of the price action should occur within the bands.

Bollinger Bands are used to measure the volatility of an asset's price. When the bands are wide, it indicates high volatility, meaning that the price is fluctuating significantly. Conversely, when the bands are narrow, it indicates low volatility, meaning that the price is relatively stable.

A "squeeze" occurs when the Bollinger Bands contract, narrowing the distance between the upper and lower bands. This signals a period of low volatility and price consolidation. It suggests that the market is in a state of equilibrium, with neither buyers nor sellers dominating. However, this state of equilibrium is often temporary. The underlying principle is that periods of low volatility are usually followed by periods of high volatility. The squeeze is thus viewed as a potential precursor to a significant price movement.

Why Volatility Contraction Precedes Expansion

The phenomenon of volatility contraction preceding expansion is rooted in market psychology and the dynamics of supply and demand. When the market consolidates, it indicates that buyers and sellers are in a temporary agreement on price. This lack of directional conviction leads to a narrowing of the price range and a decrease in volatility, resulting in a squeeze on Bollinger Bands.

However, this equilibrium cannot last indefinitely. Eventually, either buyers or sellers will gain the upper hand, leading to a surge in price. This surge in price triggers a release of pent-up energy and increased volatility, resulting in an expansion of the Bollinger Bands. The breakout from the squeeze can occur in either direction, depending on whether buyers or sellers are ultimately more powerful.

Traders often watch for the squeeze as a sign that a significant price move is imminent. The contraction of the bands represents a coiled spring, ready to unleash stored energy. The direction of the eventual breakout determines the direction of the ensuing price trend.

Identifying the Setup

The convergence of a Bollinger Band squeeze and RSI offers a potentially powerful signal for identifying entry points. This section delves into the specific conditions that constitute a valid setup, including criteria for recognizing a squeeze and analyzing RSI behavior.

Conditions for a Valid Squeeze

Defining a "valid" squeeze requires a degree of subjectivity, as there is no universally accepted quantitative threshold. However, several guidelines can help identify potential squeeze setups. One common approach is to measure the bandwidth of the Bollinger Bands, which is the difference between the upper and lower bands. A squeeze is considered valid when the bandwidth reaches a certain low percentile relative to its historical values. For instance, a squeeze might be defined as occurring when the bandwidth is in the lowest 5% or 10% of its range over the past several months. Specific parameters might need adjustment depending on the characteristics of the traded asset.

Another approach is to visually inspect the chart and look for a period of noticeable constriction of the Bollinger Bands. The bands should appear to be "hugging" the price action closely, indicating a period of low volatility. The duration of the squeeze is also a factor. A longer squeeze, lasting several days or weeks, may indicate a stronger potential for a significant breakout than a shorter squeeze.

RSI in Neutral → Overbought/Oversold Transition

The RSI adds an additional layer of confirmation to the squeeze setup. Ideally, before the price breaks out of the squeeze, the RSI should be in a neutral zone, typically between 40 and 60. This indicates that momentum is not strongly skewed in either direction.

As the price approaches a potential breakout, the RSI should begin to move towards either overbought or oversold territory, depending on the direction of the breakout. For a bullish breakout, the RSI should move towards overbought levels (above 70). For a bearish breakout, the RSI should move towards oversold levels (below 30). This confirms that momentum is building in the direction of the potential breakout and increases the likelihood of a successful trade.

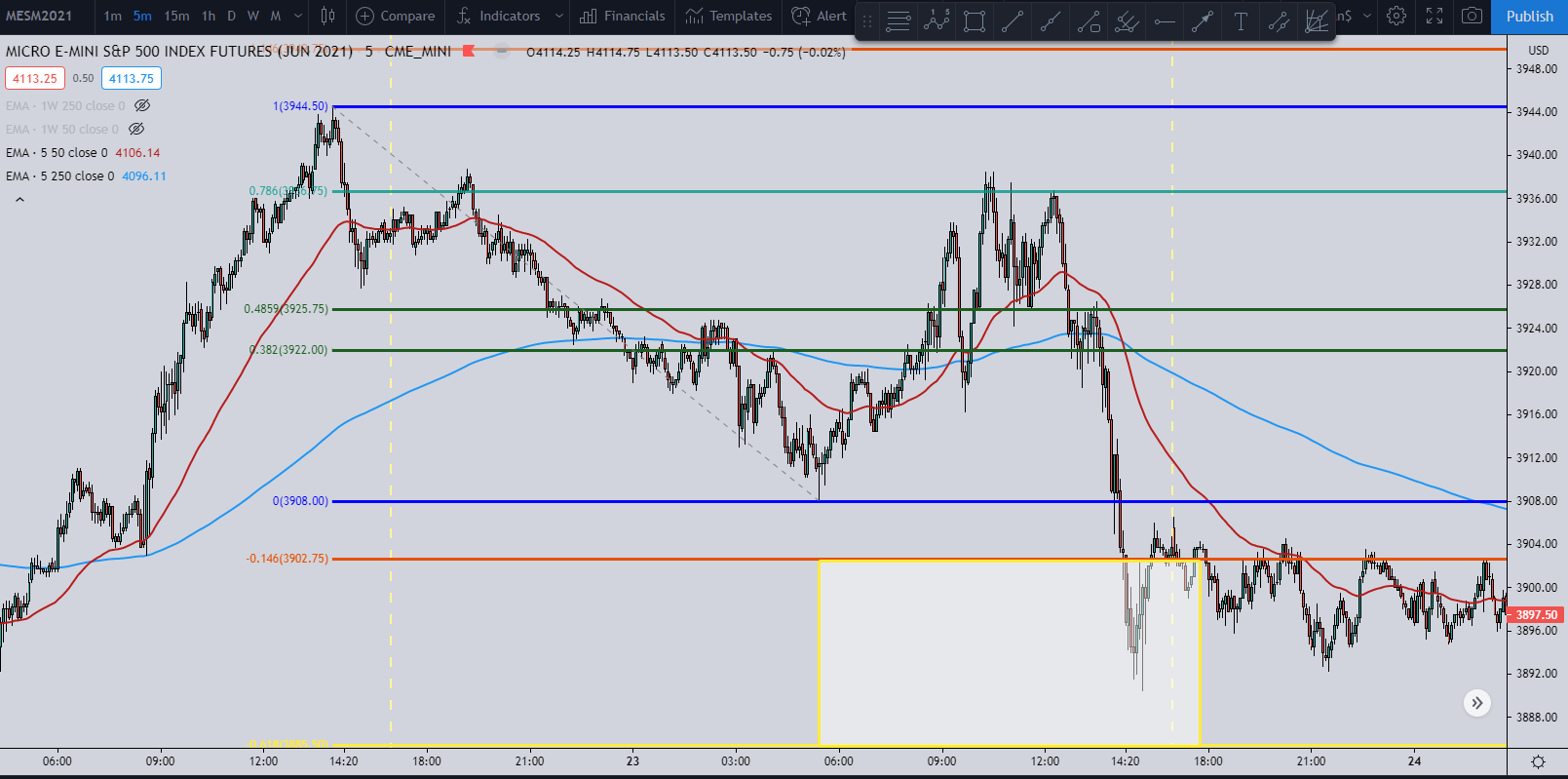

Chart Example of Squeeze + RSI Divergence

Imagine a stock price consolidating within a narrow range for several weeks. The Bollinger Bands are visibly contracting, indicating a squeeze. Initially, the RSI is hovering around 50, showing no clear momentum. Then, as the price begins to push towards the upper Bollinger Band, the RSI starts to climb, moving above 60 and approaching 70. This confluence of events – the squeeze, the price approaching the upper band, and the RSI moving towards overbought territory – represents a potential buying opportunity. Conversely, if the price were to move towards the lower Bollinger Band and the RSI were to drop below 40, it would present a potential shorting opportunity.

However, traders should also be aware of potential false signals. A squeeze can sometimes resolve in a whipsaw pattern, where the price initially breaks out in one direction before reversing and breaking out in the opposite direction. The RSI can also generate false signals, particularly in choppy markets. Using other indicators and techniques, such as volume analysis and candlestick patterns, can help filter out these false signals and improve the accuracy of the strategy.

Entry & Exit Rules

Establishing clear entry and exit rules is critical for any trading strategy. This section outlines specific guidelines for entering trades based on the Bollinger Band squeeze and RSI confirmation, as well as for setting stop-loss orders and profit targets.

Entry When Price Breaks Upper/Lower Bollinger Band with RSI Confirmation

The primary entry signal is the price breaking above the upper Bollinger Band or below the lower Bollinger Band after a squeeze has been identified. However, simply breaking the band is not enough. RSI confirmation is crucial to avoid false breakouts.

For a long (buy) entry, the price must close above the upper Bollinger Band, and the RSI must be above a certain level, such as 60 or 65. The specific RSI level can be adjusted based on the trader's risk tolerance and the characteristics of the asset being traded.

For a short (sell) entry, the price must close below the lower Bollinger Band, and the RSI must be below a certain level, such as 40 or 35. Again, the RSI level can be adjusted as needed.

It is generally prudent to wait for the price to close above or below the band before entering a trade. This helps to confirm the breakout and reduces the risk of entering on a false signal. Some traders may also use candlestick patterns to further confirm the breakout. For example, a bullish engulfing pattern occurring at the upper Bollinger Band could provide additional confirmation for a long entry.

Setting Stop-Loss Below Squeeze Base

A stop-loss order is an essential risk management tool. It automatically closes a trade if the price moves against the trader's position, limiting potential losses. For the Bollinger Band squeeze strategy, a logical place to set the stop-loss is below the base of the squeeze.

For a long entry, the stop-loss should be placed below the recent swing low that formed during the squeeze. This level represents a key support area. If the price falls below this level, it suggests that the breakout has failed and the trade should be exited.

For a short entry, the stop-loss should be placed above the recent swing high that formed during the squeeze. This level represents a key resistance area. If the price rises above this level, it suggests that the breakout has failed and the trade should be exited.

The exact placement of the stop-loss order can be adjusted based on the trader's risk tolerance and the volatility of the asset being traded. A wider stop-loss will provide more breathing room for the trade but will also result in a larger potential loss. A tighter stop-loss will limit potential losses but may also be more likely to be triggered by short-term price fluctuations.

Profit Targets Based on ATR or Recent Swing Highs/Lows

Determining appropriate profit targets is just as important as setting stop-loss orders. The Bollinger Band squeeze strategy offers several methods for setting profit targets.

One approach is to use the Average True Range (ATR) indicator. The ATR measures the average range of price fluctuations over a specified period. A common technique is to set the profit target at a multiple of the ATR. For example, the profit target could be set at 2 or 3 times the ATR from the entry price. This allows the profit target to adjust dynamically based on the volatility of the asset.

Another approach is to use recent swing highs and lows as potential profit targets. For a long entry, the profit target could be set at the next significant swing high above the entry price. This level represents a potential resistance area where the price may encounter selling pressure. For a short entry, the profit target could be set at the next significant swing low below the entry price. This level represents a potential support area where the price may encounter buying pressure.

Traders can also use a combination of these methods. For example, the initial profit target could be set at 2 times the ATR, with the possibility of adjusting the target higher if the price shows strong momentum and is approaching a significant swing high.

Risk Management Tips

Effective risk management is paramount for long-term profitability in trading. This section provides additional tips for mitigating risk when using the Bollinger Band squeeze strategy, including filtering signals, backtesting, and avoiding trading during news events.

Filtering Signals with Volume or Candlestick Confirmation

As previously mentioned, false signals can occur with any trading strategy. One way to filter out false signals is to use volume analysis. Volume should ideally increase during a breakout from a squeeze, confirming the strength of the move. A breakout with low volume may be a false signal.

Candlestick patterns can also provide valuable confirmation. For example, a bullish engulfing pattern occurring at the upper Bollinger Band, accompanied by increasing volume, would provide a stronger signal than simply a price close above the band. Similarly, a bearish engulfing pattern occurring at the lower Bollinger Band, accompanied by increasing volume, would provide a stronger signal for a short entry.

Other trading indicators such as Moving Average Convergence Divergence can be combined to confirm the trading opportunities.

Backtesting the Strategy Over Multiple Timeframes

Backtesting involves applying a trading strategy to historical data to assess its performance. This can help to identify potential weaknesses in the strategy and optimize its parameters. It is important to backtest the Bollinger Band squeeze strategy over multiple timeframes, such as hourly, daily, and weekly charts. This will help to determine which timeframes are most suitable for the strategy and to identify potential differences in performance across different timeframes.

Backtesting should also be performed on a variety of assets, as the strategy may perform differently on different assets. It is important to consider factors such as volatility, liquidity, and trading volume when selecting assets for backtesting.

Backtesting results should be interpreted with caution, as past performance is not necessarily indicative of future results. However, backtesting can provide valuable insights into the potential strengths and weaknesses of a trading strategy.

Avoiding False Breakouts During News Events

News events can cause significant price fluctuations, leading to false breakouts and whipsaw patterns. It is generally advisable to avoid trading the Bollinger Band squeeze strategy during major news events, such as economic announcements, earnings releases, and geopolitical events.

These events can create unpredictable market conditions and increase the likelihood of false signals. It is often best to wait for the market to settle down after a news event before entering a trade.

Conclusion

The combination of the Relative Strength Index and Bollinger Band squeeze offers a potent approach to spotting potential trading opportunities. By identifying periods of low volatility followed by confirmed breakouts, this strategy seeks to capitalize on the inherent tendency for markets to transition between consolidation and trending phases.

This strategy is most effective during periods of market consolidation, when the price is trading within a narrow range and volatility is low. It can be particularly useful for identifying potential breakout trades in range-bound markets. However, it is important to remember that no strategy is foolproof. False signals can occur, and it is essential to use proper risk management techniques to protect capital.

It is strongly encouraged to test this strategy with a demo account before risking real capital. This will allow for gaining familiarity with the strategy, optimizing its parameters, and assessing its performance in a simulated trading environment. Through careful analysis, disciplined execution, and effective risk management, traders can potentially leverage the combined power of RSI and Bollinger Bands to enhance their trading results.

🤖 AI-Powered Trading Indicators

Win Up To 93% of Trades With the #1 Most Profitable Indicators

Unlock the power of artificial intelligence and take your trading to the next level. Our VIP Trading Indicators are designed to help you dominate any market — Forex, Crypto, Stocks — with up to 93% accuracy.

Gain instant 24/7 access to 5+ powerful, battle-tested indicators built to predict market trends with precision. Whether you're a beginner or an expert, these tools are optimized for all skill levels and work on any device.

✓ 30-Day Money Back Guarantee — Try Risk-Free!